What Is Payroll?

Payroll involves calculating, managing, and distributing employee payments. Planbiq simplifies tracking time, calculating earnings, deducting taxes, and ensuring timely payments.

Here are the 3 easy steps

Payroll involves calculating, managing, and distributing employee payments. Planbiq simplifies tracking time, calculating earnings, deducting taxes, and ensuring timely payments.

Planbiq simplifies payroll processing, ensuring accuracy, efficiency, compliance, and security. It empowers your organization to make informed decisions and manage payroll-related processes effectively.

Planbiq ensures secure and accurate payroll. Automation minimizes errors, guaranteeing correct, timely payments. State-of-the-art encryption keeps your data safe and confidential.

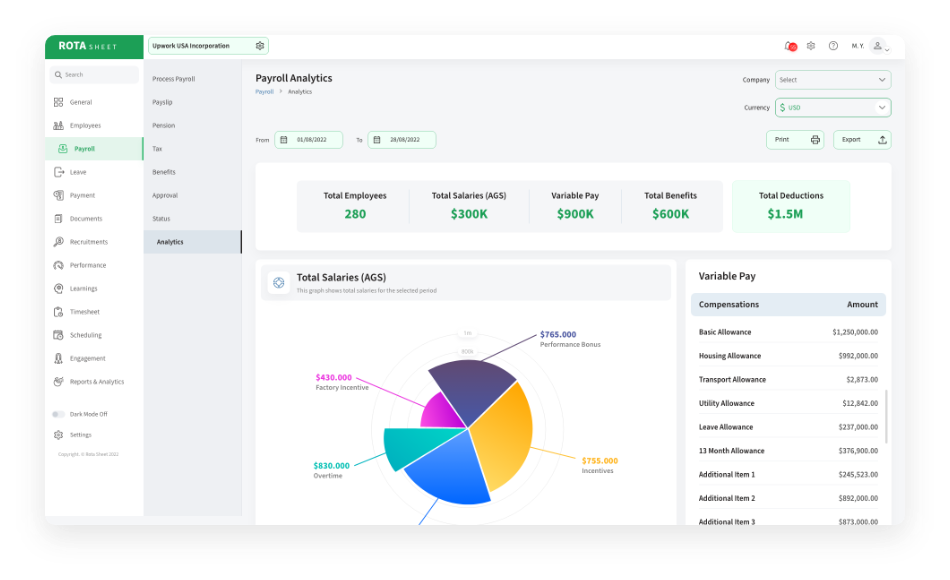

Planbiq offers advanced reporting and analytics, enabling organizations to generate detailed payroll reports and insights, supporting better decision-making and financial planning.

Planbiq automates tax calculations, deductions, and withholdings, ensuring compliance with laws and regulations. This reduces non-compliance risks and penalties, providing confidence in payroll management.

Planbiq is a time-saver that automates payroll processes and eliminates repetitive tasks. It frees HR and payroll teams to focus on strategic initiatives that add value to the organization, reclaiming time from administrative duties.

With Planbiq's key features, businesses of all sizes and industries can streamline payroll processes, ensure compliance, enhance accuracy, and improve employee compensation and benefits efficiency.

Planbiq efficiently computes wages, taxes, deductions, and net pay based on attendance data and payroll rules. It streamlines payroll, reduces errors, ensures timely payments, and frees up valuable time for other tasks.

Support the company's strategic objectives with a powerful and intuitive payroll system.

Oversee all financial aspects of the company, ensuring payroll aligns with financial strategies and compliance requirements.

Integrate the payroll system seamlessly with other enterprise systems, maintain data security, and comply with IT policies.

Manage employee compensation and benefits, ensuring seamless integration with payroll systems for informed decision-making.

Manage payroll processing effectively and efficiently with an intuitive system.

Manage and monitor labor laws and regulations, avoiding legal issues and penalties with an error-free payroll system.

Planbiq simplifies payroll management in a complex global business environment, easing the burden of complexity. It supports strategic objectives, enhances the employee experience, and provides reassurance in handling intricate payroll tasks.

Planbiq streamlines payroll by efficiently managing attendance, leave, and performance data. Its intuitive software simplifies payroll operations, employee payments, and tax remittances, ensuring regulatory compliance for businesses.

Access our flexible software anytime, anywhere, on any device for seamless usability.

Answers to your questions can be found here.

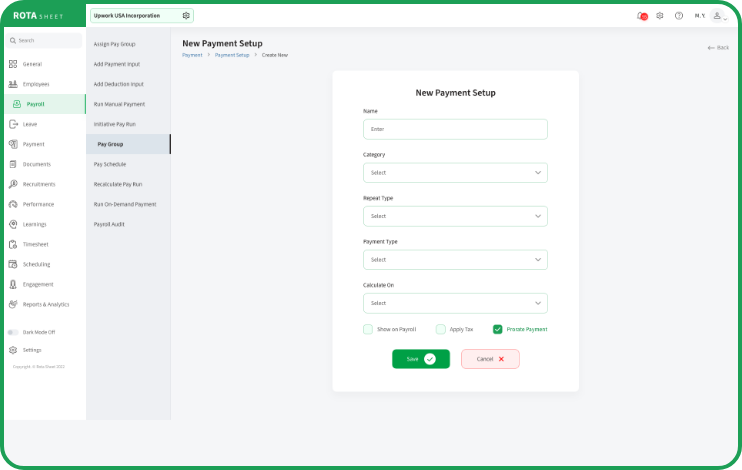

Planbiq offers customization options to tailor the Planbiq payroll solution to your business requirements, such as setting up unique pay structures, benefits, earning types, deduction types, etc.

Planbiq payroll solution is secure, protecting sensitive employee data and permitting access only to authorized personnel. It also ensures compliance with data privacy regulations.

Yes, the Planbiq payroll solution can handle various types of employee compensation, including hourly wages, salaries, bonuses, commissions, and overtime pay.

Yes, the Planbiq payroll solution offers integration functionality with other HR and accounting systems to streamline data exchange and ensure data consistency across systems.

The frequency of payroll processing depends on your business's pay schedule, but the Planbiq payroll solution currently accommodates weekly, bi-weekly, semi-monthly, or monthly pay cycles.

Yes, you can access your pay information online through the employee self-service portal.

Planbiq payroll solution automatically calculates tax deductions based on employee information and current tax laws. It also generates tax and pension information and provides it to facilitate filing with relevant government authorities.

Yes, the Planbiq payroll solution can handle complex payroll for multi-company, including multi-state or international payroll, by supporting different tax laws, currencies, and regulatory requirements.